How to Register and Trade CFDs at Octa

How to Register Account at Octa

How to Register a Trading Account

To open a trading account, please, follow the step-by-step instruction:

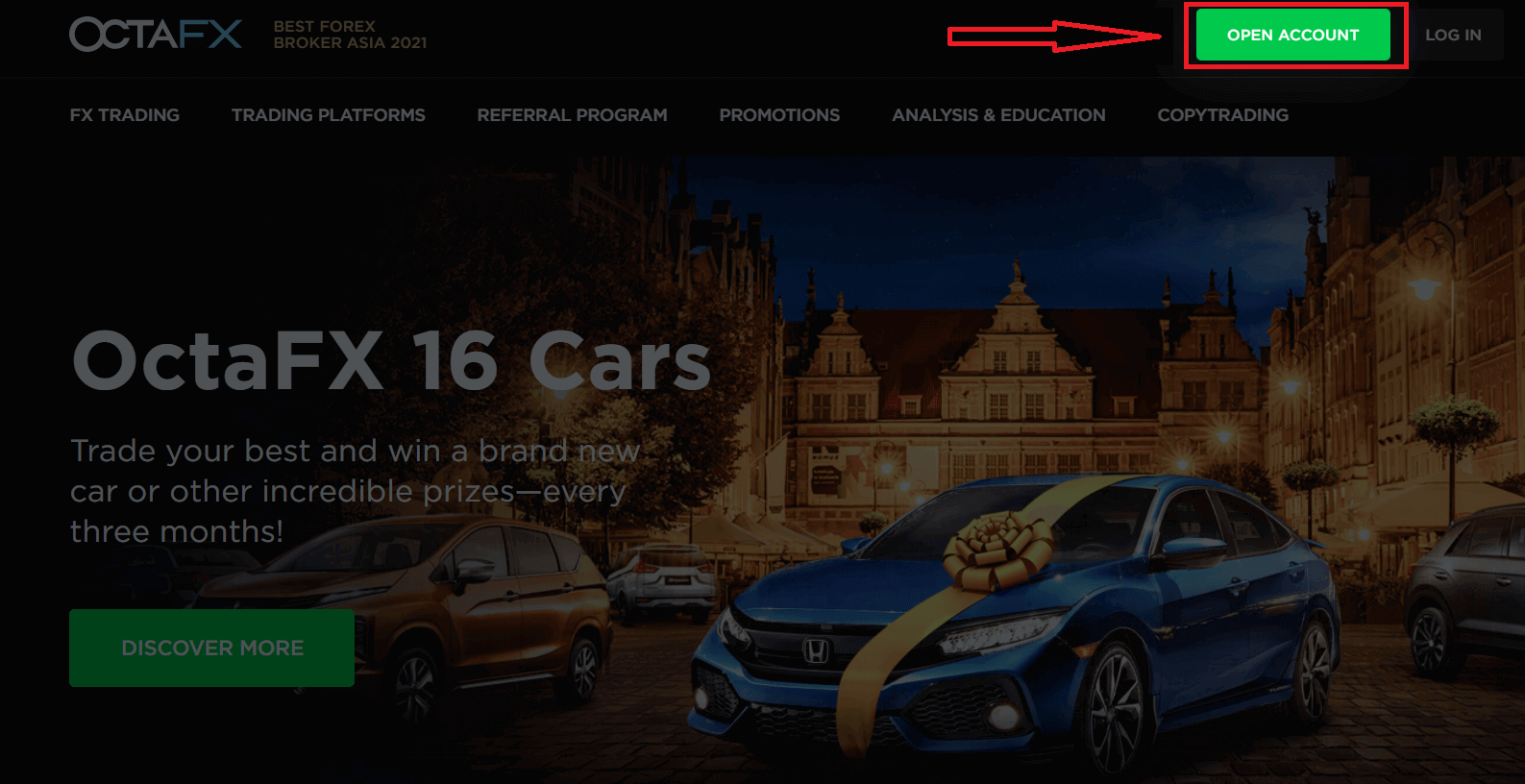

1. Press the Open Account button.

The Open Account button is located at the top right corner of the webpage. If youre having trouble locating it, you can access the registration form using the signup page link.

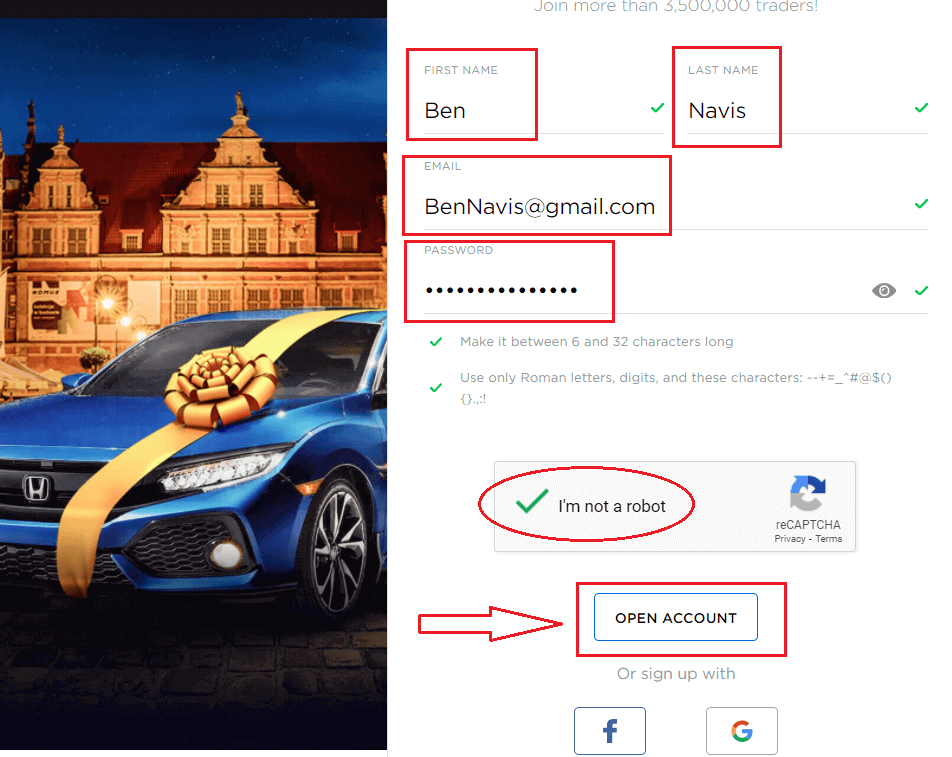

2. Fill in your details.

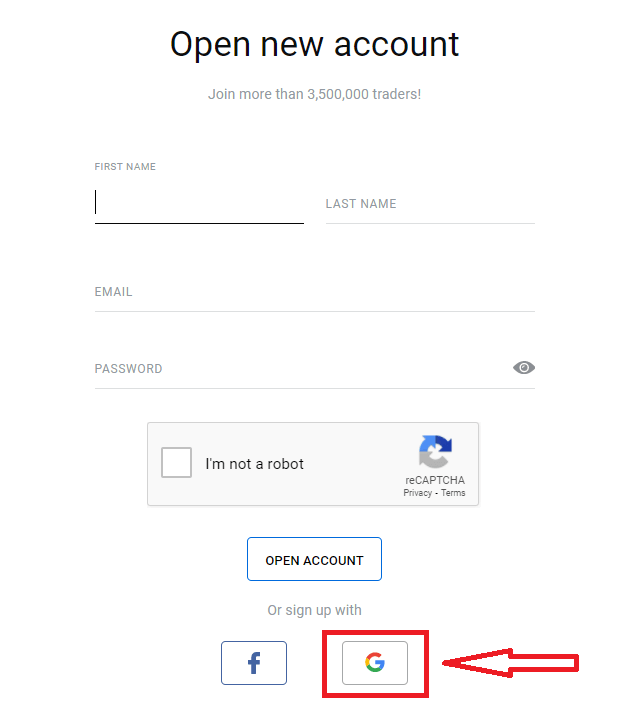

After pressing the Open Account button, youll come across a registration form asking you to fill in your details. After filling in your details, press the Open Account button below the form. If youve selected to sign up with Facebook or Google, fill in the missing information and press continue.

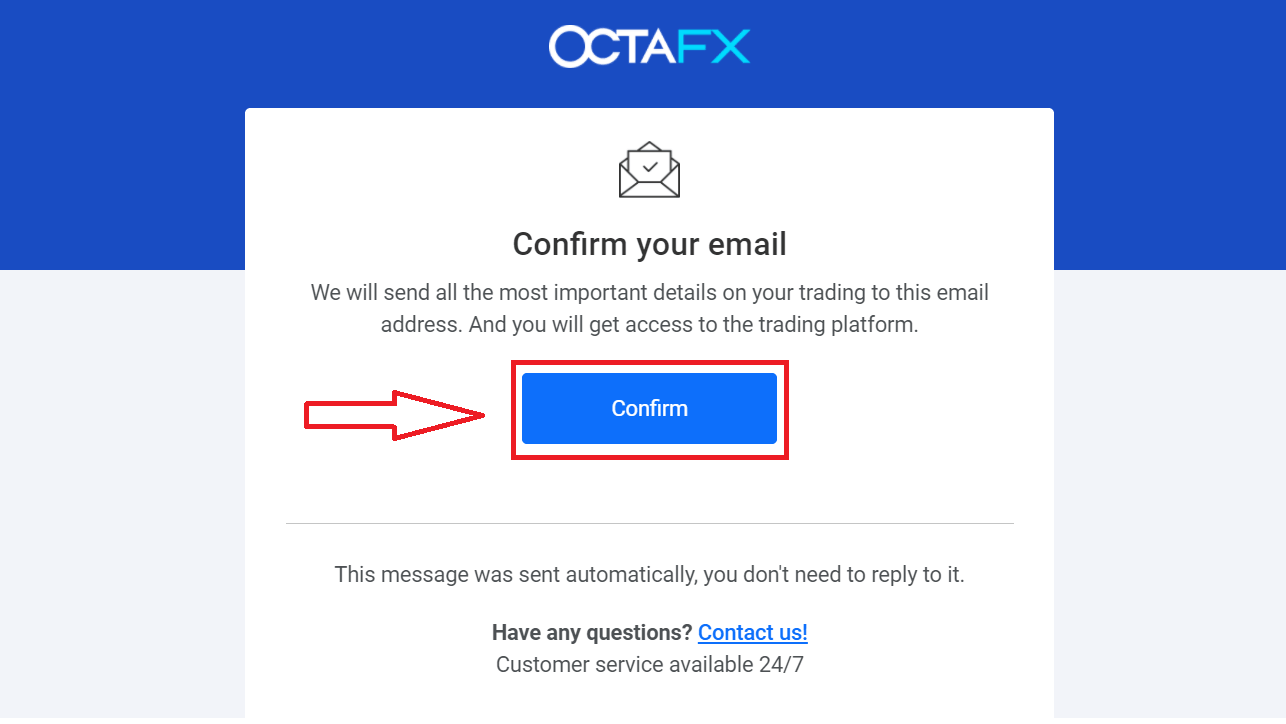

3. Verify your email address.

After providing your details and submitting the form, youll be sent a confirmation email. After locating and opening the email, press Confirm.

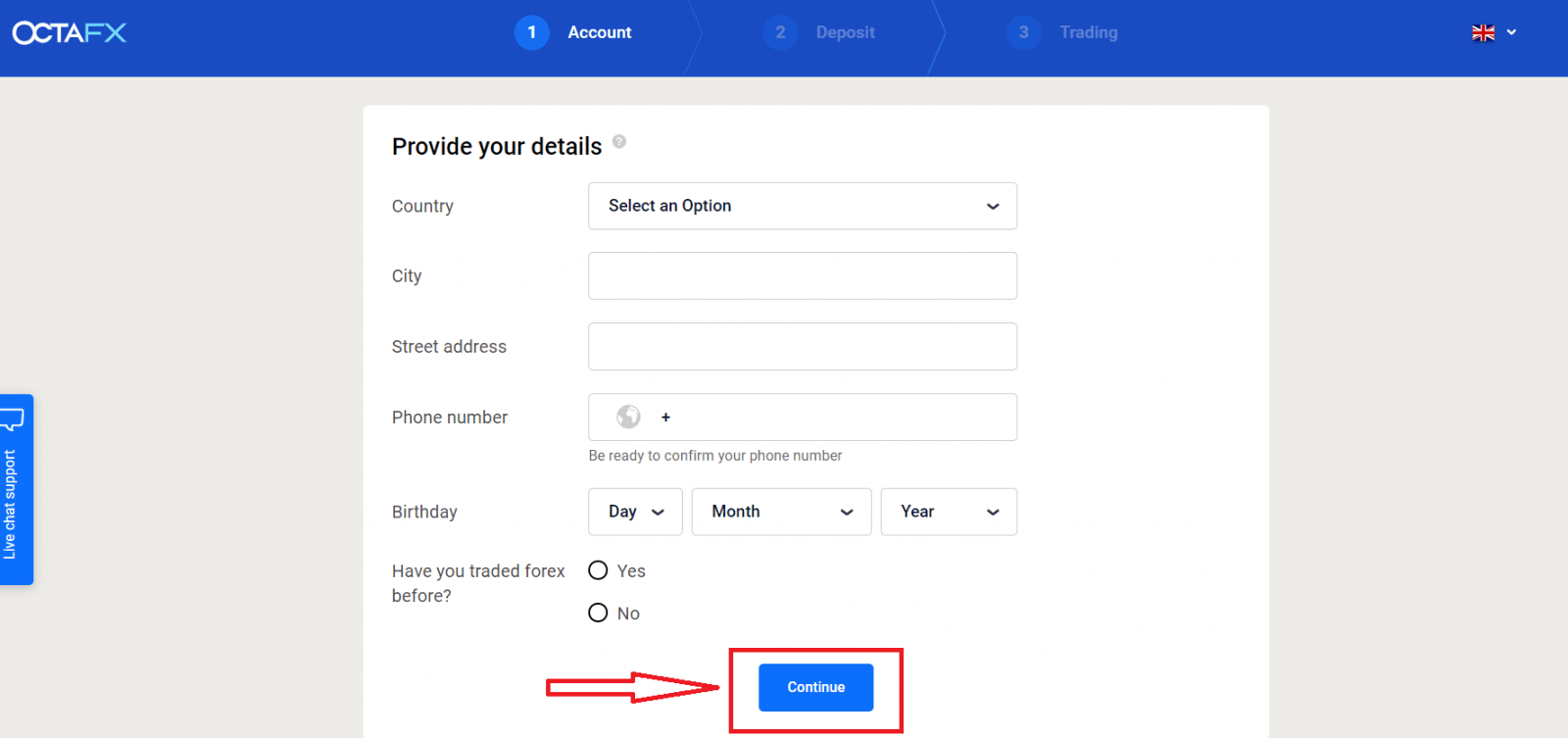

4. Fill in your personal details.

Following confirming your email, youll be redirected to our website to fill in your personal details. The information provided must be accurate, relevant, up-to-date, and subject to KYC standards and verification. Please notice that you need to be of a legal age to trade Forex.

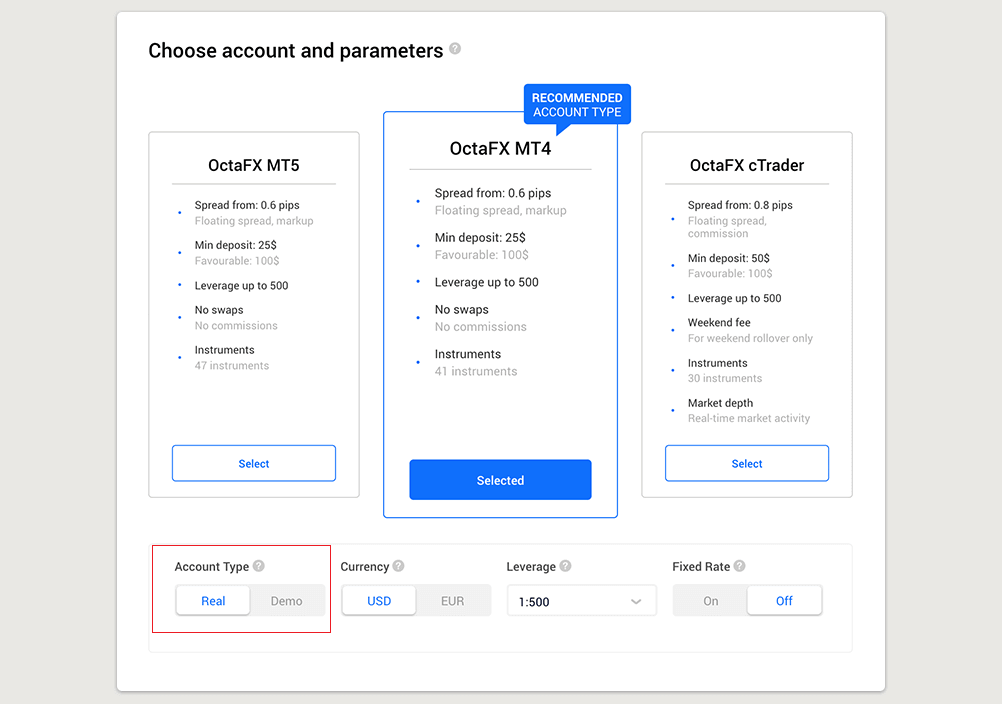

5. Select a trading platform.

Next, youll need to choose which trading platform you want to use. Be prompted to select between either a real or a demo account.

To understand which account is best for you, you should check our detailed comparison of Forex accounts and their types and compare trading platform features from Octa. Most clients typically choose the MT4 platform.

Once youve selected your desired platform, youll need to choose whether you want to open a real or a free demo account. A real account uses real money, while a demo account allows you to use virtual currency with no risks.

While you cannot withdraw funds from the demo account, you will be able to practice strategies and become acquainted with the platform without a hassle.

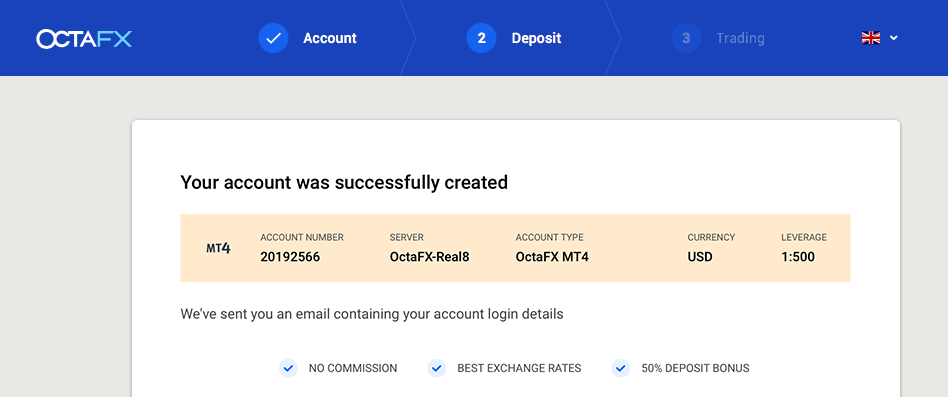

6. Complete account choice.

- After choosing a platform, press Continue to finalize your account creation.

- You will see a summary of your account, including:

- Account number

- Account type (demo or real)

- Currency of your account (EUR or USD)

- Leverage (you can always change it in your account later)

- Current balance

7. Make your first deposit and submit a verification document for withdrawal.

You can then make your first deposit, or you can first complete the verification process.

Please, notice that according to our AML and KYC policies, our clients must verify their accounts by providing the required documents. We request only one document from our Indonesian clients. You need to take a photo of your KTP or SIM and submit it. This way validates you are a sole holder of a trading account and ensures no unauthorized access.

Following the steps above allows you to create a trading account on Octa. To start trading, you need to initiate the deposit process.

Read how to deposit at Octa.

Before opening an account, it’s important to familiarise yourself with this information:

- Please, read the customer agreement thoroughly before you open an account.

- Forex margin trading involves substantial risks. Before entering the Forex market, you need to be aware of the risks involved.

- AML and KYC policies are in place to protect accounts from unauthorized access. To secure transactions, we require documents verification.

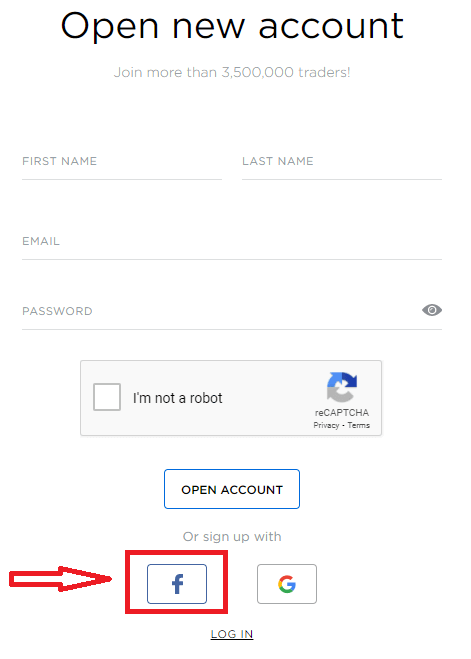

How to Register with a Facebook account

Also, you have an option to open your account through web by Facebook and you can do that in just few simple steps:1. Click on Facebook button

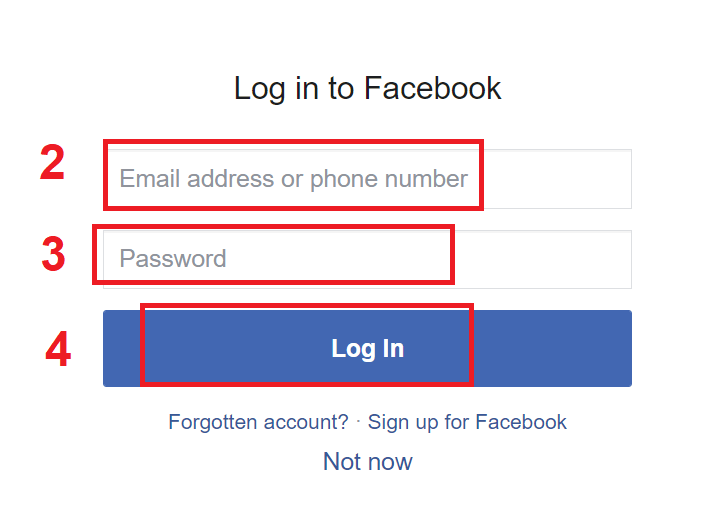

2. Facebook login window will be opened, where you will need to enter your email address that you used to register in Facebook

3. Enter the password from your Facebook account

4. Click on “Log In”

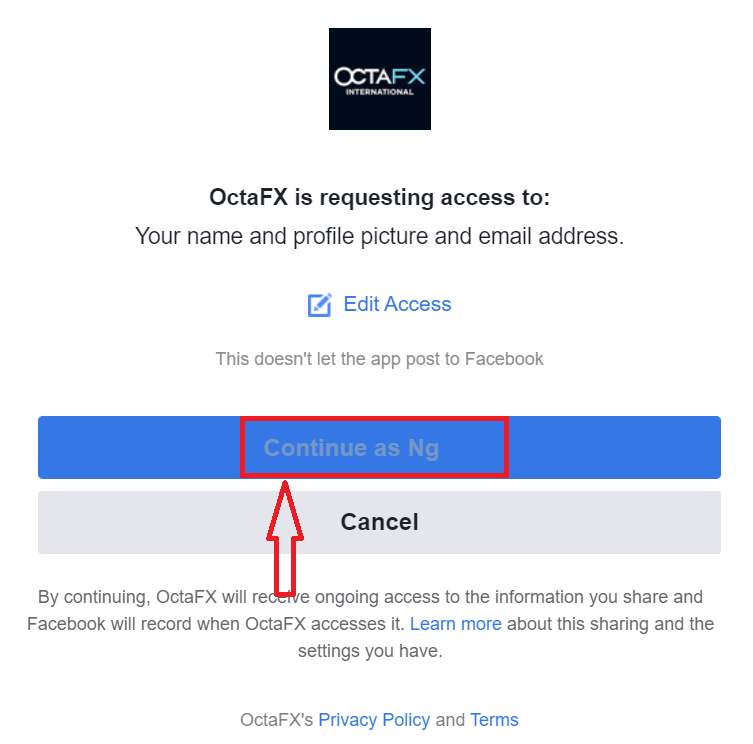

Once you’ve clicked on the “Log in” button, Octa is requesting access to: Your name and profile picture and email address. Click Continue...

After That You will be automatically redirected to the Octa platform.

How to Register with a Google+ account

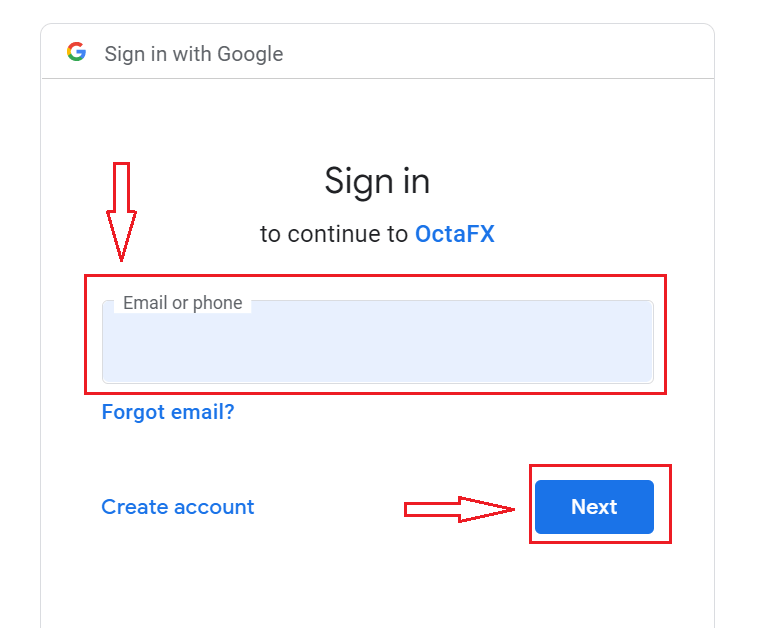

1. To sign up with a Google+ account, click on the corresponding button in the registration form.

2. In the new window that opens, enter your phone number or email and click “Next”.

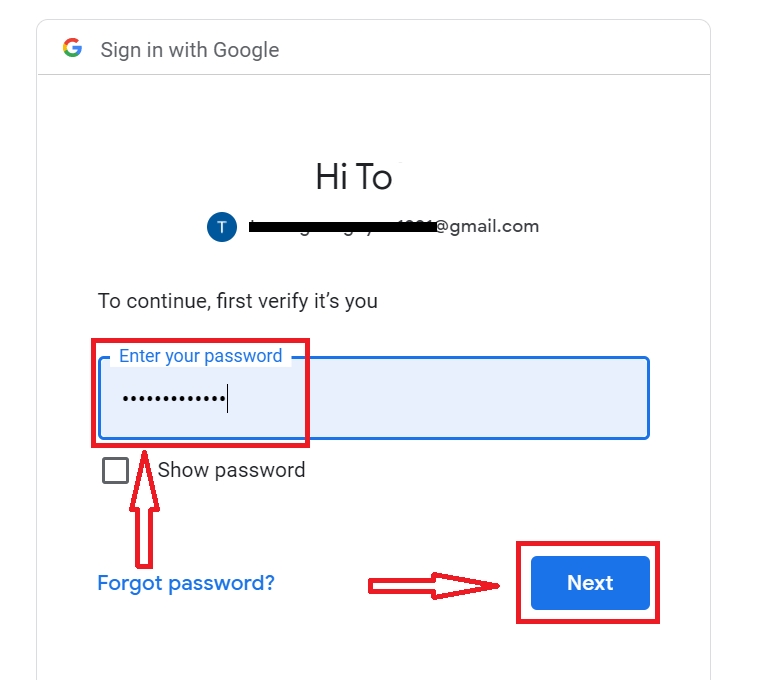

3. Then enter the password for your Google account and click “Next”.

After that, follow the instructions sent from the service to your email address.

Octa Android App

If you have an Android mobile device you will need to download the official Octa mobile app from Google Play or here. Simply search for “Octa – Mobile Trading” app and download it on your device.

The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, Octa trading app for Android is considered to be the best app for online trading. Thus, it has a high rating in the store.

FAQ of Account Opening

I already have an account with Octa. How do I open a new trading account?

- Sign in to your Personal Area with your registration email address and Personal Area password.

- Click Create account button on the right of My accounts section or click Trading Accounts, and select Open real Account or Open demo account.

What type of account should I choose?

It depends on the preferred trading platform and the trading instruments youd like to trade. You can compare account types here. If you need to, you can open a new account later.

What leverage should I select?

You can select 1:1, 1:5, 1:15, 1:25, 1:30, 1:50, 1:100, 1:200 or 1:500 leverage on MT4, cTrader or MT5. Leverage is virtual credit given to the client by the company, and it modifies your margin requirements, i.e. the higher the ratio, the lower the margin you need to open an order. To choose the right leverage for your account you can use our Forex calculator. Leverage can be changed later in your Personal Area.

How to Trade CFDs at Octa

How to trade index CFDs

The major stock market indices such as FTSE 100, Dow Jones, SP and Germanys DAX index tend to respond well to technical analysis and are generally more preferred by short term traders. Other popular indices include Frances CAC-40 and Japans Nikkei 225.Fundamentals-wise, it would mainly depend on the country the index originates from as well as the economic sectors it represents. Below you will find a brief description of the major indices we offer for trading.

The Dow Jones Industrial index

Symbol: US30Trading hours: Monday - Friday, 01.00 - 23.15, 23.30 - 24.00

Thanks to the volatility of the US markets, the Dow Jones industrial index is one of the most popular instruments among the traders. Comprised of 30 major US companies, the Dow Jones provides a cross-section of the US economy and, consequently, is affected by the news releases from the region.

The Standard and Poors 500 Index

Symbol: SPX500Trading hours: Monday - Friday, 01.00 - 23.15, 23.30 - 24.00

Another popular US index is the Standard Poor’s 500 compiled from the share values of 500 largest companies in the United States. As it covers 70% of the stocks market, SP500 can be considered a better benchmark of the US economy than the Dow Jones.

The Nasdaq 100 Index

Symbol: NAS100Trading hours: Monday - Friday, 01.00 - 23.15, 23.30 - 24.00

The NASDAQ 100 index comprising of the 100 largest companies listed on the NASDAQ exchange reflects a number of industries including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. With the influence all these sectors have on the economy, one can expect the index to be significantly affected by the financial news from the US.

The ASX 200 Index

Symbol: AUS200Trading hours: Monday-Friday, 02.50-9.30, 10.10-24.00

Based on the Sydney Futures Exchange (SFE) Share Price Index Futures contract, the Aussie 200 index measures the movement of various sectors of the Australian Stock market. Along with responding to economic news and reports from Australia, it is also affected by changes in commodity prices as the Australian Economy is highly dependent on them.

Nikkei 225 Index

Symbol: JPN225Trading hours: Monday-Friday, 02.00-23.00

Often referred as to the Japanese Dow Jones equivalent, the Nikkei 225 is a stock index for the Tokyo Stock Exchanged comprising of Japans top 225 companies, including Canon Inc., Sony Corporation and Toyota Motor Corporation. As the Japanese economy is highly export oriented, the index may be affected by some of the economic news from the US.

Eurostoxx 50 Index

Symbol: EUSTX50Trading hours: 9.00-23.00

The Euro Stoxx 50, designed by Stoxx Ltd, is a capitalisation weighted index made up of the largest companies across several industries, including SIEMENS, SAP, SANOFI, BAYER, BASF, etc. In total, the index covers 50 companies from 11 EU countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain.

DAX 30

Symbol: GER30Trading hours: 9.00-23.00

Another popular capitalisation weighted index, the German DAX, is comprised of the top 30 companies trading on the Frankfurt Stock Exchange, including BASF, SAP, Bayer, Allianz, etc. It is commonly believed to be a good market with substantial volumes, as it tends to trend for several hours at a time with relatively small pullbacks. As all major stock indices, it normally responds well to technical analysis and is affected by economic news from Germany and the EU in general.

IBEX 35

Symbol: ESP35Trading hours: 10.00-18.30

The IBEX 35, mapping the 35 most liquid Spanish stocks, is the benchmark stock market index of the Bolsa de Madrid. As a capitalisation weighted index, it is based on the free float method, which means that it counts the shares that are in the hands of public investors, as opposed to the restricted stocks held by company insiders. Some of the largest companies it consists of are BBVA, Banco Santander, Telefónica and Iberdrola, however, it is important to note that the list is reviewed and updated twice a year.

CAC 40

Symbol: FRA40Trading hours: 9.00-23.00

Another European free float market capitalisation weighted index, the CAC 40 is the benchmark index of the stock market in France. It represents the top 40 stocks traded on the Euronext Paris stock market. As France represents about a fifth of the European Economy, it might provide an insight of where the European market is heading, as well as present an opportunity to profit from its own price fluctuations. The CAC 40 covers stocks across multiple industries, including pharmacology, banking and oil equipment.

FTSE 100

Symbol: UK100Trading hours: 9.00-23.00

Also called the footsie, the Financial Times Stock Exchange 100 is a market capitalization weighted index representing the top 100 blue chip companies on the London Stock Exchange. The index is said to map more than 80% of the total capitalization in the United Kingdom. Stocks are free-float weighted to ensure that only the investable opportunity set is included within the index. The FTSE group manages the Index, which in turn is a joint venture between the Financial Times and the London Stock Exchange.